- All

- Ascend Executive

- Ascend Team

- Autumn 2023 Newsletter

- Awards

- Business

- Care

- Charity

- Charity Insurance

- Charity Support

- Claims

- Commercial

- Construction

- COVID-19

- Credit

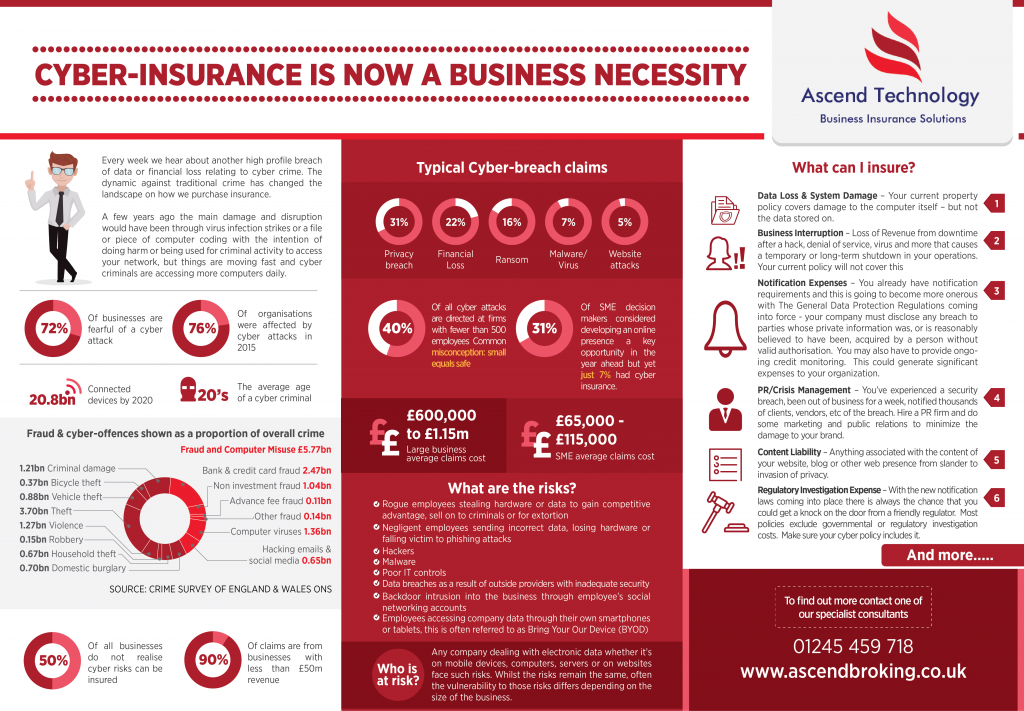

- Cyber

- Directors & Officers

- Engineering

- Environmental

- Executive Personal Lines

- Fire/Security

- Fleet

- High Net Worth Insurance

- Liability

- Marine

- More Trees

- Motor Market

- Motor Trade

- Professions

- Property Owners

- Rail

- Real Estate

- Risk Management

- Self Insurance

- Sponsorship

- Spring 2017 Newsletter

- Summer 2023 Newsletter

- Team Members

- Transportation

- Underinsurance

- Unrated Insurers

The Property Insurance Market Update Part 1

The Property Insurance Market Update Part 1 Over the past three years, the UK Property Insurance market has faced significant challenges, driven by the cost of materials, labour shortage, inflation and a change in reinsurance (capacity and cost for insurance on large losses) which has resulted in double digit rate increases. In 2023,…

Autumn Newsletter 2023

Autumn Newsletter 2023 We are pleased to enclose your copy of our autumn newsletter, Covernotes. A digital PDF version is available to download here. This issue of Covernotes contains the following articles: Start your ‘Martyn’s Law’ Terror Security Planning Right Now Make Contract and Intention Identical to Avoid a Co-insurance Claim…

Preserving History – Storing Classic Cars

Preserving History: A Guide to Storing Classic Cars The classic car could be the ultimate ‘toy’ for the high net worth individual, with many beautiful cars taking pride of price in the discerning collector’s armoury, but how should these pieces of history and works of art on wheels be stored? Whether you're an avid…

A Guide to Freight Forwarders Insurance in the UK

A Guide to Freight Forwarders Insurance in the UK Introduction Every year, a significant number of shipping containers is lost during transit. This, coupled with the occurrence of damaged goods upon delivery, has emphasised the importance of insurance in the logistics sector. Let's delve into the world of Freight Insurance and Cargo Insurance –…

How to protect against fire from lithium batteries

Lithium batteries in the home – how to protect against fire The use of lithium-ion batteries in household items has increased due to their ability to store more energy, providing longer usage times. While these batteries are generally safe when used properly, there can be serious consequences if they are not handled correctly. Here are…

The personal motor insurance market – challenging times

The personal motor insurance market – challenging times The UK motor market has seen month-on-month premium rate increases over the last few months as Ernst and Young (EY) tell of insurers experiencing their “worst performing year in a decade in 2022”. This is due to: Rising inflation Higher wages Historical low premiums Increase in cost…

Warehouse & storage conditions for insurance purposes

Warehouse & storage conditions for insurance purposes Warehouses are essential for many businesses, providing a safe and secure place to store inventory, raw materials, and finished goods. However, not all warehouses are the same, and different warehouse storage conditions are required for different types of products. In this blog post, we will explore why it…

The widening gap of property underinsurance

The widening gap of property underinsurance Concerns grow as an increasing number of UK properties are now underinsured. With the gap between property rebuild costs and their sums insured widening at an alarming rate. RebuildCostASSESSMENT.com has complied figures from their annual report on rebuild costs and has concluded, from almost 27,000 rebuild valuations…

Underinsurance risk to high net worth individuals

Underinsurance risk to HNW individuals High net worth individuals are falling prey to underinsurance in the face of rising inflation rates and the pressures of the UK’s cost of living crisis. New research from specialist insurer, Ecclesiastical, supports this, with a statement released on the 19th June 2023 revealing that of 119 brokers interviewed…

Important changes in the home claims market

Important changes in the home claims market One of the effects of a challenging financial climate is changes in the home claims market. In 2022, UK construction costs rose to a 40-year high as we saw prices soar in raw materials, fuel and energy, and this has meant unprecedented challenges for insurers. There are…

Summer 2023 Covernotes Newsletter

Summer 2023 Covernotes Newsletter We are pleased to publish our summer 2023 Covernotes newsletter. A digital PDF version is available to download here. This issue of Covernotes contains the following articles: Why offering private medical insurance could be good for your business Earthquakes highlight imperative nature of supply-chain risk mitigation Don’t cause…

Insurers write off vehicles due to parts supply delays

Understanding the challenges of written-off vehicles: implications for car owners and insurers The fast-paced automotive industry is currently facing a troubling issue. The issue involves a growing number of vehicles that insurers write off due to delays in parts supply, causing frustration among car owners and uncertainty in the insurance industry. This article aims to…

Cyber Security: The Unseen Threat of Social Engineering

Understanding Social Engineering At the heart of cyber security, understanding social engineering is crucial. This psychological manipulation is often overlooked, and can dupe unsuspecting individuals into revealing confidential information. Predators employ cunning tactics, influencing victims to break standard security practices, so it's essential to recognise this covert threat in our digital age. Recognising these attacks…

Chess Homeless – Super Sleepout

Ascend's Charity Fundraiser Last Wednesday, six members of Ascend Broking participated in the remarkable Essex Super Sleepout charity fundraiser. They braved a night sleeping rough at The Essex County Cricket Ground to raise funds for two worthy charities: CHESS Homeless Charity in Chelmsford and the Essex Cricket Foundation. CHESS Homeless Charity provides support…

Motor Trade Underinsurance

Motor trade underinsurance Underinsurance is a common problem in the motor trade industry, where businesses often struggle to obtain adequate coverage for their vehicles, equipment, and premises. Underinsurance occurs when a business fails to insure its assets for their full value. As a result, this can leave the business exposed to significant financial losses in…

Paul “Benno” Bennett at the National Over 70’s England Trials

Paul “Benno” Bennett at the National Over 70’s England Trials We are thrilled to announce that Paul "Benno" Bennett, a prominent member of Ascend, is set to compete in the National Over 70's England Trials on April 6th, 2023. Bennett's passion for football has not faded over the years. He continues to play over 45's…

Why Business Interruption is so Important for Coffee Roasters

Why Business Interruption is so Important for Coffee Roasters Coffee roasters, like any other business, need to have plans in place for business continuity in the event of unexpected disruptions or emergencies. Business continuity planning is the process of developing strategies and procedures. it enables a business to continue operating during and after an…

Modern Methods of Construction

As an insurance broker who provides expert support and advice for businesses in the construction industry, we keep a close eye on MMC, or Modern Methods of Construction. What is insurance for modern construction? MMCs are currently revolutionising the construction industry by providing new ways of building that are faster, cheaper and more sustainable than…

Why Haulage Firms need a Personal Broker

Haulage insurance is a crucial aspect of any transportation business. It protects business owners from financial losses arising from theft, damage to goods in transit, accidents and other unforeseen events. However, finding the right haulage insurance policy can be a daunting task, especially for those who are new to the industry. This is where a…

Are you Fully Aware of your Business’s Exposures?

Are you Fully Aware of your Business’s Exposures? Are you a business owner? Then, you need to know the different risks your business may face. These could be things like cyber threats, fire, floods, and other potential losses. These problems could cause financial loss, damage to your property, or even legal troubles. But don't worry,…

Warehouse & Storage Conditions for Insurance Purposes

Warehouse and storage conditions for insurance purposes Why is it important to know your warehouse storage conditions for insurance purposes? Knowing your warehouse storage conditions is crucial for insurance purposes. Insurance companies require accurate information about your products’ storage conditions to provide the right coverage for your business. Failure to provide accurate information about your…

Why Insurers may Refuse Claims from your Company

Commercial insurance policies are designed to protect businesses from unexpected losses. However, just because a business has an insurance policy does not guarantee that they will receive coverage when they file a claim. Insurance companies have a responsibility to properly evaluate claims and only pay out when the terms of the policy have been met.…

How Underground Cable Strikes can Affect Groundwork Companies.

Underground cable strikes can have catastrophic consequences for groundwork companies, often resulting in significant financial losses and reputational damage. However, with the right insurance coverage, owners of these companies can mitigate their risk and protect themselves from the financial burden that often accompanies such incidents. The Importance of Insurance Coverage As a groundwork company owner,…

From Rental Woes to Relief: Navigating Hired in Plant Insurance Claims

Hired in plant insurance is an important type of insurance for businesses that rely on plant or equipment rentals. It provides protection against damage or loss of equipment that is rented from a third party. Hired in plant insurance claims can be complex, and it is important to understand the process in order to ensure…

How to Prevent Keyless vehicle Theft

How to Prevent Keyless vehicle Theft Keyless vehicle theft is on the rise, fuelled in part by both the higher demand for used cars and vans, and gaps and shortages in the supply chain for replacement parts due to Brexit and Covid. The Home Office reports that every five minutes in the UK, a vehicle…

How Important is D&O within the Wholesale Sector?

Directors and Officers (D&O) insurance is an important aspect of the wholesale industry, as it protects the leaders of a company from potential legal claims related to their decision-making processes and actions. The wholesale industry involves large transactions and complex operations, making D&O insurance a critical component for ensuring the stability and success of companies…

The Difference Between ‘Joint Names’ and ‘Composite Insured’ Construction Insurance

The Difference Between ‘Joint Names’ and ‘Composite Insured’ Construction Insurance Most people in the construction industry will know that contract works are usually determined by standard form contracts called JCTs (or Joint Contracts Tribunal contracts) which outline the responsibilities and obligations of all parties involved in the project i.e., the employer, contractors, and any subcontractors.…

How Your Business Can Reduce Their Motoring Costs

How Your Business Can Reduce Their Motoring Costs Rising motoring costs are a concern for all businesses that have a motor fleet. If you run a fleet of vehicles as part of your business, you’ll be keeping a close eye on balancing the cost of keeping your fleet on the road with the difficulties of…

Safety Practices Regarding Lithium-Ion Batteries

Safety Practices Regarding Lithium-Ion Batteries Lithium-ion batteries (also known as li-ion batteries) are in many everyday appliances - both in the workplace and the home - and have become commonplace, but they pose a fire risk not everyone may be aware of. Let’s take a closer look at these batteries and the sensible precautions you…

Why all businesses require Directors and Officers insurance

Why all businesses require Directors and Officers insurance Directors and Officers liability insurance (D&O insurance) provides financial support and defence against potential investigations into the behaviour of your executives and the possibility of them being sued. Without such insurance, the company will be left to pick up the tab from their own resources. Or,…

What can Fleets Expect in 2023?

What can fleets expect in 2023? 2022 was a wild ride for the trucking industry, but as we enter autumn many are wondering what will happen next. Sean Storey of Capital Equipment spoke recently at NationaLease, offering his thoughts during their recent Annual Meeting about how he thinks things may play out over the coming…

3 Changes in Transportation in 2023

3 changes in Transportation in 2023 The transportation industry is always adapting to changing times and circumstances. With such an influential impact on other sectors, it’s important for businesses in this space to keep themselves informed about what will come next year so they can plan accordingly – both now (to avoid surprises) as well…

8 Ways to Tackle Underinsurance

8 Ways to Tackle Underinsurance Underinsurance can be devastating, especially when it comes to your business property and its contents, should you ever be in the unfortunate position of having to make a claim. Here are 8 ways to avoid it: Get your property valued regularly The cost of building materials has risen significantly in…

Top 6 Cybersecurity Trends to Watch Out For in 2023

Top 6 Cyber security trends to watch out for in 2023 - Rise of automotive hacking - Potential of artificial intelligence - Mobile is the new target - Data breaches: prime target - Targeted ransomware - Insider threats Rise of automotive hacking: The use of wireless communication systems in modern vehicles has created a vulnerability…

Construction – Problems with Products

What is Part Product? In the last few weeks I have seen trade advertising from different major insurers announcing that their Construction policy now has an optional extension for what is known as Part Product. Well, this is not something new, as I have been including this important extension since the early 1990s. Liability Insurance?…

Legal News – Three Items of Interest for the Construction Community

Phoenixing: Construction bosses who 'phoenix' firms could now face fines or bans Construction is one of the UK industries that suffers the most from ‘phoenixing’ – folding a firm to avoid debts, then starting up a near identical business with a new name. Now directors who do this could face hefty fines or being banned…

How Does Cyber Insurance Work and What Does it Cover?

How does cyber insurance work and what does it cover? How does cyber insurance work? You have a small business that sells leather goods online and you collect customer data including credit card numbers. You are hacked by cybercriminals who steal all this information from 1K of your customers' accounts- making them victims, too! Your…

Why you Need Cyber Insurance

Why you need cyber insurance... The risks of cyber crime have never been more prevalent, with attacks on businesses increasing each year. Cyber risk insurance is a must for any company that holds personal data or stores business critical information electronically. If your computer system fails due to interference from outside forces, you could lose…

10 UK Cybercrime Statistics

10 UK Cybercrime statistics Did you know as of October 2022, 39% of UK businesses have experienced a cyber attack, the same as in 2021. However, the figure has dropped since 2020 (46%). “Cyber crime is the greatest threat to every company in the world.” - According to 31% of these businesses, they were attacked…

Autumn Risk Bulletin

Autumn Risk Bulletin In this issue: - Welcome to Autumn - Autumn weather - Road traffic collisions - Sharing the road space safely - Engineering inspection - Slips, trips, and falls - Building enclosures, balconies, terraces and outside heating - Escape of water - Aviva’s specialist partners Download the autumn risk bulletin Here. Bought to…

Guide to Motor Claims Inflation

Guide to motor claims inflation In this issue: - Executive summary - Pandemic impact - Brexit - War in Ukraine - Technological advancement - What about injury claims? - It’s not all bad news - What’s AXA doing to help? - Vehicle damage claims - Injury claims Download the motor claims guide Here. There are…

Electric Cars and What to Consider

Electric Cars and What to Consider... The ban on new petrol and diesel cars is fast-approaching, with the cut-off date of 2030 looming on the horizon, and the number of electric cars on the road is rapidly increasing, accounting for 11.6% of UK new car sales in 2021. Yet, many are still hesitant to opt for electric vehicles for…

The UK Broker Awards

The UK Broker Awards We’ve done it again! Ascend have bagged their 9th award, by winning the Customer Service Award at the UK Broker Awards on 16th September. The UK Broker Awards are the leading platform for national recognition within the insurance broker market. Held last week at The Brewery, in the City of London,…

The Insurance Times Awards 2022

The Insurance Times Awards 2022 Ascend Broking Group is thrilled to be nominated for 3 awards in the upcoming 2022 Insurance Times Awards – bringing our total number of nominations up to 30! Designed to recognise and celebrate excellence and innovation across the breadth of UK general insurance, these awards shine a light on outstanding…

Digital Broker of the Year 2022!

Digital Broker of the Year 2022! Organiser: Broker Innovation Awards Category: Digital Broker of the Year Date: 8th September 2022 We are delighted to have been awarded Digital Broker of the Year 2022 at The Broker Innovation Awards. The Broker Innovation Awards recognise the specific implementation of an innovation in insurance brokerage, be it in service…

AXA UK warns of serious fire risk of lithium batteries

AXA UK warns of serious fire risk of lithium batteries - Improper storage and damage to the lithium-ion batteries in electric bikes and scooters can result in devastating fires - AXA has covered almost half a million pounds of losses over the last two months on fires caused by lithium batteries - Not leaving the…

Ascend Broking Summer Newsletter 2022

Ascend Broking Summer Newsletter 2022 Welcome to our summer newsletter. This month I would like to raise 2 key exposures to your business – underinsurance and your personal negligence exposure. Underinsurance - why inflation can have a major impact on your insurance A not-so-well understood risk is the impact of inflation on insurance and the…

The changing risk profile of hauliers

How hauliers can manage the risks associated with inflation The current inflationary and supply chain challenges in the UK has added pressure on historically thin profit margins for fleet and haulage operators. Here are some tips to help with risk management. - Proactive accident avoidance strategies. - Managing inexperienced drivers - Driver training programmes. -…

We are now proud sponsors of Chelmsford City FC

We are now proud sponsors of Chelmsford City FC! We are delighted to announce that we have extended our support to Chelmsford City FC with an agreement to become the Club’s official sponsor for the 2022/2023 season. General Manager, Phil Crowe, said: "Ascend Broking Group and MD Matthew Collins have been excellent supporters of the…

Ascend Broking Newsletter 2022

Ascend Broking cover notes Summer 2022 Explaining issues that affect your insurance... In this issue: - Insurance fraud does not pay - Bullying: workplace trials and tribunals - Business travel polices offer many benefits - Inflation impacts on property insurance - Cover your event eventualities - Is it covered? DOWNLOAD COVER NOTES Insurance fraudsters beware! The…

“35% are opting for EV as their next car purchase. Are you tempted yet?

A new study has found that a third of people (35%) are likely to choose an electric vehicle for their next vehicle purchase as a result of the recent fuel crisis. Based on the findings of the survey, Volkswagen Financial Services UK reported that the number of used electric vehicles it finances increased by 76…

Motor dealers: are you EV ready?

Motor dealers: are you EV ready? The interest in electric vehicles is now increasing as automakers strive to meet the governments goal of net zero emissions by 2050. This month, the National Franchised Dealers Association (NFDA) revealed that over 200 dealers have been accredited under its Electric Vehicle Approved (EVA) programme, which has been reopened.…

Disruption in supply chains for Motor Trade

Motor Trade supply disruption Ever since the COVID-19 outbreak, supply chains have faced major disruptions in the automotive industry. Several manufacturing companies have had to modify their approaches as a result of the impact of the pandemic on the supply and demand from customers, businesses, suppliers and governments. According to a recent survey conducted by…

Motor Trade business continuity: 3 tips to combat change

Motor Trade business continuity: 3 tips to combat change Managing a diverse and agile supplier network is now a top priority in the auto industry and essential to remaining competitive. No matter if shifting to the production of electric vehicles, dealing with the current semiconductor shortage or mitigating everyday disruptions, the automotive OEM and aftermarket…

Ascend nominated for 4 awards at the Broker Innovation Awards 2022!

Ascend nominated for 4 awards at the Broker Innovation Awards 2022! The Broker Innovation Awards seeks to reward companies, employees and teams that truly understand their customers and the market. The Broker Innovation Awards culminates in The Broker Innovation Award, a recognition of a specific implementation of an innovation in insurance brokerage, be it in service delivery, pricing, technology,…

Rolex and Patek Philippe owners watch for underinsurance

Rolex and Patek Philippe owners watch for underinsurance Some luxury watches have more than tripled in price – even for second-hand watches – meaning that many clients are at risk in the event of a loss of a huge gap between the insured value and the replacement cost. This is called Underinsurance. The economy has…

Inflation rate for motor claims settled in 2021 reached 6.2%

Inflation rate for motor claims settled in 2021 reached 6.2% Average claims settlement times in Q1 2021 were two months longer compared to the same period in 2019. Motor claims inflation is expected to accelerate in 2022 following a 6.2% increase in 2021, according to new research published by our network partner Willis Towers Watson (WTW).…

Vulnerable road users’ awareness guide for employers

Vulnerable road users' awareness guide for employers In conjunction with AVIVA we are pleased to share with you our new VRU awareness guide for employers. The document includes: - Statistics on incidents involving VRUs. - A closer look at some of the key emerging risks such as updates to the law and guidance as well…

What employers should do during a heatwave

What employers should do during a heatwave? The Met Office has issued an ‘extreme heat’ warning, meaning there is a real danger to health for the UK population. What does this mean for those of us that are working during the heatwave? Are employers obligated to keep the temperature in the workplace below a certain…

Directors & Officers: Motor Trade

Directors & Officers: Motor Trade What is Directors & Officers (D&O) Insurance? Director and Officers Insurance is sometimes known as “Management Liability” and it’s there to protect you financially against any claims made against you personally as a director, partner or officer of your business. From health and safety concerns to a claim for breach…

5 mega trends to watch in 2022

5 mega trends to watch in 2022 Global economic developments and insolvency exposures 2021 proved to be volatile for businesses and their officers, pummeled by a ‘perfect storm’ of exposures: from the economic downturn to a global pandemic to unstable political developments and an unprecedented warning of insolvencies to come. Markets are expected to remain…

Ascend nominated for 4 awards at the UK Broker Awards 2022!

Ascend nominated for 4 awards at the UK Broker Awards 2022! The UK Broker Awards seeks to reward companies, employees and teams that truly understand their customers and the market. Ascend Broking has been shortlisted for: - Commercial Lines Broker of the Year - Digital Broker Award - ESG Broker Champion - Sustainability - Customer…

D&O insurance structure

What is the structure of D&O insurance? The structure of a D&O insurance policy depends on which of three insuring agreements are purchased (ABC policies are generally chosen, as these are standard form policies for publicly listed companies. For private or non-profit companies, only AB policies would be used) [see table]. Directors and officers are…

The UK Health & Protection Awards 2022

The UK Health & Protection Awards 2022 – SMP Healthcare for Best Small Protection Advice Firm Wednesday 12 October 2022, London Hilton on Park Lane The UK Health & Protection Awards is the eminent celebration of excellence in professional standards and innovation shown by intermediaries and providers to individuals and corporate customers across the disciplines…

BIBA Manchester

Ascend attend the British Insurance Brokers’ Association The British Insurance Brokers’ Association (BIBA) is the UK’s leading general insurance intermediary organisation representing the interests of insurance brokers, intermediaries and their customers. BIBA membership includes around 1800 regulated firms, employing more than 100,000 staff. General insurance brokers contribute 1% of GDP to the UK economy; they…

Ascend Free Security Survey – find out more

Did you know? • 36% of all burglaries are crimes of opportunity, with burglars letting themselves in through unlocked doors or windows. • You are ten times more likely to be burgled if you don’t have basic security. Even something as simple as putting strong locks on your doors and windows will keep your house…

Employment Practice Liability cover – what is it?

Employment Practice Liability cover - what is it? The Cause British law works on the principle that someone accused of wrongdoing is innocent until proven guilty. In the workplace this means that when handling a disciplinary issue with a member of staff the employer must follow due process, investigate the allegation and be sure that…

Engineering contractors

Engineering contractors Engineering plays a hugely important part of the UK economy, accounting for more than a quarter of the UK’s total GDP with nearly 50,000 contractors working in the sector. The vast majority of engineering contractors are experienced professionals and rarely make mistakes – but understanding the risks involved with each project is important…

What to do after a break in

What to do after a burglary If you've been through the unsettling experience of a burglary, you're certainly not alone. According to security experts IFSEC Global, there is an attempted burglary every 45 seconds in the UK; every 76 seconds there's a successful one. The idea an intruder has entered your house can come as…

Motor Fleet – 8 tips to keep your insurance cost down

Motor Fleet - 8 tips to keep your insurance cost down Our specialist transportation division is able to provide our clients with exclusive discounts often not available in the open market and our integrated IT system ensures you benefit from instant quotes and immediate cover. Motor fleet - Haulage Fleet Motor Fleet - Courier Fleet…

What is business interruption?

What is business interruption? At the outset of your claim, it is essential that work is focused on establishing liability acceptance from your insurance company. A delay in getting liability accepted on a commercial loss can have dire consequences for any business’s future, as cash flow can be impacted for several months. With Morgan Clark…

The 8 most unusual insurance requests made by high net worth customers

The 8 most unusual requests made by high net worth customers to insure! A household name insurer looking back over the last ten years, Aviva has listed its strangest claims and requests for insurance cover from its high net worth customers, including an ornamental Ferrari, a 72 foot dinosaur and a pesky badger! Aviva has…

Why an independent broker?

Why an independent broker? We know that buying insurance can be difficult. Searching the market for the right product at the right price can be exhausting – and once you’ve found a product, how do you know that you’ve got the right level of cover? An independent insurance cover can make the process much easier,…

Why insurance is important to you and your family

Why insurance is important to you and your family Protection for you and your family Your family depend on your financial support to enjoy a decent standard of living, which is why insurance is especially important once you start a family. It means the people who matter most in your life may be protected from…

What are your self-insurance options?

What are your self-insurance options? Self-insurance is one way businesses can maintain some control over their own risks, while still being able to purchase protection at higher entry levels when needed, through an insurer - at rates much lower than those offered by traditional programmes. What can self-insurance programmes cover? Almost any type of traditional…

D&O insurance explained

D&O insurance explained D&O insurance policies offer liability cover for company managers to protect them from claims which may arise from the decisions and actions taken within the scope of their regular duties. 5 key insurance issues - Increased corporate governance means more D&O exposures - D&O insurance covers claims resulting from managerial decisions that…

How to get redundancy right

How to get redundancy right Last month P&O Ferries found themselves in deep water after dismissing 800 of their employees without notice via a video message. Redundancy is a tricky issue to navigate, here’s how to make it as painless as possible for both employer and employee: Is redundancy appropriate? To follow a fair redundancy…

Ascend Broking Newsletter Spring 2022

Ascend Broking Cover notes Spring 2022 Explaining issues that affect your insurance In this issue - Business Interruption - Construction Delays - Martyn’s Law - Flooding - Is it covered? DOWNLOAD COVER NOTES Business success typically relies on a business carrying out its planned activities uninterrupted. It can, therefore, be beneficial to have insurance to…

Ascend is shortlisted at The British Insurance Awards 2022

Ascend is shortlisted at The British Insurance Awards 2022 for Commercial Broker SME/Mid-Corporate of the Year About the British Insurance Awards The British Insurance Awards celebrate ingenuity and exceptional achievements in the UK insurance industry over the past 12-18 months. Their aim is to put the spotlight on companies that are embracing innovation and positively…

Spring risk management bulletin

In conjunction with AVIVA we have prepared an interactive spring risk management guide on how you can take reasonable precautions to protect your business against the common risks encountered in the spring months. DOWNLOAD RISK MANAGEMENT GUIDE This edition focuses on: - Simple risk assessment advice specifically for the season - Assessing how equipped you…

Our Why…

Our Why This year, we want to support another local charity that focuses on children and families in the local community. Having read what Kids Inspire are doing, we jumped at the chance to make them our charity of the year! Three of our team have decided to take up the challenge to cycle from…

5 key areas you need to be aware of for spring

5 key areas you need to be aware of for spring - An Aviva Risk Management Solutions guide: April showers The UK continues to experience unpredictable extremes of weather as climate change becomes more of a factor. Spring 2020 was the sunniest ever recorded, but we only have to look back to spring 2012, where…

Two-fifths of London firms at risk of climate-fuelled flash floods

Two-fifths of London firms at risk of climate-fuelled flash floods London is facing an increasingly urgent problem as climate change increases the risk of flash floods. The capital's 42% at-risk commercial buildings are vulnerable to surface water flooding, which caused chaos last summer when torrential downpours hit London. Imagine a city where every commercial or…

Why cyber risk should be a priority for every boardroom

Why cyber risk should be a priority for every boardroom Cyber security is a top priority for many organisations, but the task can seem daunting. It’s now possible to make your business more secure with less risk to be hacked into, thanks not only to modern technology and resources like analytics tools—but also by making…

Is my jewellery underinsured?

Is my jewellery underinsured? The demand for expensive jewellery such as watches and rings are increasing at a great rate. In some cases, supply can't keep up, causing prices to rise. In the last 10 years some jewellery has seen a higher increase in value than gold. Could this affect your insurances? With the rises…

Commercial Broker of The Year 2022

Ascend are crowned Commercial Broker of The Year at The National Insurance Awards 2022 The first awards of the year and a major event in the insurance sector, aiming to highlight and honour innovation and achievement. We competed against and fought off some worldwide nationals and we are delighted to have been awarded this award…

What to do after storm damage

What to do after storm damage Recent storms Eunice and Franklin hit the UK hard this February, causing plenty of destruction. So, what do you need to do, following a storm, if damage has been caused to your business or property? The clear up operation Report your claim as soon as possible. Contact us with…

Download our guide on the recent Highway Code changes

Download our guide on the recent Highway Code changes. We have recently seen a new set of Highway Code changes set to be adopted as law. This will have an impact on all drivers and could even expose fleet operators to negligence claims as more responsibility will fall to drivers. - New Hierarchy of Road…

What insurance do I need to be a courier?

What insurance do I need to be a courier? With many companies growing an online presence, the courier industry has boomed due to more and more people ordering online and businesses looking to couriers to help them with their distribution. So, if you're reading this with the idea of entering the industry, this could be…

Two major storms are forecast, are you prepared for a storm?

Two storms are forecast to bring disruptive winds, rain and potential snow to many UK areas from today. Both yellow and amber weather warnings have been issued for Storm Dudley, which is expected to impact the north of the UK and Wales from Wednesday afternoon. Wind gusts may reach up to 80-90 mph in some…

ERN explained – Everything you need to know

ERN explained - Everything you need to know ERN stands for Employers Reference Number. This reference is made up of two parts: - A three digit HMRC office number - A reference number unique to your business Depending on when this number was issued to you, it can look slightly different. - If issued prior to…

Why you need a transport specialist insurance broker

Why you need a transport specialist broker At Ascend we provide transport specialist insurance. We have 100+ combined years of experience in the transport insurance market. We even have an account executive who is an ex-driver himself. Therefore, we have a good insight into the industry and what risks you may face, with great access…

What is a virtual fleet manager, and why do you need one?

What is a virtual fleet manager, and why do you need one? A virtual fleet manager is an invaluable asset for business owners who rely on a large number of vehicles to conduct their operations. By using a fleet manager, business owners can improve their efficiency and optimise their resources. In this blog post, we…

Brexit causing more distribution delays in 2022

Brexit causing more distribution delays in 2022 Some lorries bringing goods from the EU to the UK have been stuck at the border for four days. The disruption has been blamed on "terrible" new Brexit red tape. Truck drivers have reported queueing for up to eight hours trying to get through customs controls at the…

Big issues facing the UK haulage industry in 2022

Big issues facing the UK haulage industry in 2022 Covid and Brexit will continue to affect the haulage industry in 2022, but there are other questions in the UK haulage industry that will unravel as the year goes on. Newly trained HGV drivers – will they be in it for the long haul? You may…

Chubb Insurance launch a new risk management guide

Chubb insurance launch a new Risk Management guide, designed specifically for businesses involved in the technology sector. The technology industry is fast moving and, in today’s environment, technology companies are constantly exposed to a multitude of known and unforeseen risks. The aim of this guide is to highlight the challenges faced by businesses and to…

Welcome, Steven Gillespie, to the Ascend team!

Welcome, Steven! We are delighted to announce the addition of Steven Gillespie to Ascend Broking, as an Account Executive. Steven joined Ascend in December 2021, having previously worked at Devitt Insurance for 8 years across multiple departments including Personal Lines, High Net Worth and Commercial. He has a keen interest in the Motor Trade and…

Bad weather – the need for a sound fleet insurance policy

Bad weather reinforces the need for sound fleet insurance policy Winter weather fleet insurance policy Significant storms, like many we have witnessed in recent years, and bad weather prevent many workers from being able to report for work, creating significant declines in revenue for the duration of the bad weather, or even for a longer…

How to safely walk on ice

Winter is coming...! And with it, undoubtedly, will be periods of snow and ice, not only providing jeopardy on our roads, but posing an issue when it comes to walking anywhere. All it takes is for you to step incorrectly onto an icy patch and you can fall over. While the odd stumble may not…

Is your business ready for winter?

With temperatures dipping and heavy rain in the forecast, many businesses could find themselves unprepared when normal winter weather suddenly turns extreme. A severe cold spell or abnormal levels of snowfall could cause significant interruption to your business’s operations, in addition to property damage and potential safety issues for staff, visitors and general members of…

Multifactor Authentication (MFA)

What is a Multifactor Authentication (MFA)? What is MFA? Multifactor Authentication (MFA) is the use of two or more authentication factors. MFA is successfully enabled when at least two of these categories of identification are required in order to successfully verify a user’s identity prior to granting access. Something you know: A password or passphrase…

Sport and leisure

Managing your exposures – the sport & leisure industry Some risks are common to all in the property and casualty areas, such as exposures for fire, flood or slips & trips. In addition, Business Interruption is a big consideration for those with a reliance on a specific location – for example a hotel or leisure…

Multi-Factor Authentication Special Edition 2021

Multi-Factor Authentication Special Edition 2021 Multi-Factor Authentication (MFA) requires the user to provide two or more methods to verify their identity in order to access a resource. Instead of just asking for a username and password, MFA requires one or more additional verification factors, which decreases the likelihood of a successful cyber-attack. Solely having a…

Why travel insurance is more important than ever in 2021

Why travel insurance is more important than ever as we reach the end of 2021 Travel insurance has never been so important as we continue to navigate Covid-19 in our overseas holidays and trips. It will cover you for unexpected situations both while away and in the run up to your holiday, from losing your luggage to covering…

Christmas opening hours

Christmas opening hours 24th December – 9am to 1pm 25th December – closed 26th December – closed 27th December – closed 28th December – closed 29th December – 9am to 4pm 30th December – 9am to 4pm 31st December – 9am to 1pm 1st January – Closed 2nd January – Closed Outside emergencies can be…

National Insurance Awards 2022

National Insurance Awards 2022 – Finalist – Commercial Insurance Broker of the Year On the 5th December the judging panel announced the finalists for the 2022 National Insurance Awards. We are delighted to have been shortlisted for The Commercial Insurance Broker of the Year 2022. Thank you to our clients, insurers, and the team at…

Ascend Risk – business continuity & risk management

We have launched a new unique combination of cloud-based management systems, onsite risk consultancy and engagement. Ascend Risk management systems can be deployed across your business in minutes, delivering day-to-day functionality, visibility and accountability to your risk management process. We can also provide onsite risk consultancy to help you develop your risk controls including: -…

Why should hauliers use Returnloads?

Why should hauliers use Returnloads? Is your business currently facing pressure to improve efficiency and increase profitability? This is the situation for many haulage companies today. From poor fleet management to the resources that are wasted on empty journeys, your current working practices could be costing your business unnecessarily. Returnloads is a platform designed to provide…

Top 5 causes of workplace injuries

Top 5 causes of workplace injuries Employee safety is a top priority for any employer. Employees are the driving force of your business and need to be able to work in a safe environment to ensure efficiency and productivity. Knowing the most common workplace injuries and ways to prevent them can decrease the number of…

Lowering employment practices liability risks

Lowering employment practices liability risks Employment practices liability insurance (EPLI) is a critical type of cover that provides various protections for policyholders. Employers face a variety of risks related to employment practices liability claims. These claims became more common every year in the UK between 2015 and 2018. An EPLI policy can have a major…

How COVID-19 is changing mergers and acquisitions

How COVID-19 is changing Mergers and Acquisitions The pandemic's effects on the economy and innovation open opportunities for retail investments Fundamental shifts in retail have created “not just new ways of shopping,” says John Potter, U.S. Deals Partner at PwC — they’ve also created “new ways of being.” Potter, who advises corporate and private equity…

Any use of hand-held mobile phone while driving to become illegal

Any use of hand-held mobile phone while driving to become illegal Police will soon be able to more easily prosecute drivers using a hand-held mobile phone at the wheel after the government strengthens existing laws to further improve road safety. It is already illegal to text or make a phone call (other than in an…

Is it worth investing in driver and vehicle safety?

Investing in your drivers By investing in driver and vehicle safety you can save 78% in damage costs and 7% in fuel, according to Driving for Better Business figures. Who wouldn't want that? But there is no doubt it'll cost you to invest into Driving for Work schemes, so you may be thinking - is…

5 ways to improve your motor fleet and reduce premiums

5 ways to improve your motor fleet and reduce premiums Motor fleet is a large percentage of a company's insurance spend. These 5 easy to follow tips could help you improve your motor fleet claims experience and reduce your premiums. 1. Motivate your drivers Motivating drivers to perform well can be a highly effective method…

The financial implications of operating without Professional Indemnity Insurance

The financial implications of operating without Professional Indemnity Insurance Operating without professional indemnity insurance leaves your business open to claims and, in turn, huge financial risk. The costs of a claim can quickly reach hundreds of thousands and even millions. Most insurers offer policies which provide cover from an indemnity limit of £50,000 as standard.…

Acquisition of SMP Healthcare

Acquisition of SMP Healthcare We are delighted to announce that from the 5th November 2021, SMP Healthcare Ltd has become part of the Ascend Broking Group. Based in Chelmsford, Essex and established in 2014, the team at SMP Healthcare provide access to a wide range of Health and Protection insurance policies on both personal and…

7 top tips on Professional Indemnity Insurance

Deciding how much professional indemnity cover you need This is a common issue. Ultimately, it depends on your business, your clients and your potential liability. Your professional indemnity insurance needs to be able to cover the total rectification costs of your negligence and the legal costs of a claim against you. Some professional bodies will…

Don’t take the bait: how to safeguard your business from phishing attacks

Don't take the bait: how to safeguard your business from phishing attacks What is phishing? Phishing is more than just a misspelt variation of a popular countryside activity. It’s also a key risk to businesses – one that we all need to be aware of. Simply put, phishing is any attempt to trick a victim…

The insurance market is changing

The insurance market is changing... what can you do about it? The insurance market operates in a similar way to many other marketplaces, in that it uses simple supply and demand principles. When there is an over-supply of product (too many insurance companies), prices are driven down; when supply is reduced or demand increases, prices…

Can the Covid-19 recovery be green

Covid-19 has delivered one of the biggest shocks in modern history and has impacted the way we live our lives, from how we shop, to how we work, including how we get there. One silver lining to the economic slowdown has been the fast and unprecedented reduction of CO2 emissions. As we start to…

Do small businesses need employment practices liability insurance (EPLI)?

Do small businesses need employment practices liability insurance (EPLI)? EPLI is a type of small business insurance that helps you pay for lawsuits related to workplace discrimination and harassment. The United States has several federal laws that make it illegal for employers to treat prospective, current, and former employees differently based on their sex, colour,…

Recognising and responding to abuse

Recognising and responding to abuse It can be extremely difficult for children, young people and vulnerable adults to speak out about abuse. Often the fear of negative consequences from speaking to anyone outweighs the safety it could bring. Some may delay telling someone about abuse for a long time, while others never tell anyone, even…

COVID-19: The Impact on Marine Protection and Indemnity Coverage

COVID-19: The Impact on Marine Protection and Indemnity Coverage Amid the tragic human impact of COVID-19 and governments' restrictions on travel and commerce, businesses are feeling the economic consequences of the pandemic. COVID-19 has reshaped the marine sector's risk landscape, and raised questions about shipowners' protection and indemnity (P&I) coverage and how this may be…

What are your options for reducing your fleet numbers?

What are your options for reducing your fleet numbers? The current uncertainty in the haulage industry is causing people to think about their current fleet numbers. With a potential downturn in business, with driver shortages or just a reduction in volumes, it’s best to know your options so you can make the best decision. Own…

What Ascend’s Private Hire insurance covers and the optional extras you can add to your policy.

What Ascend's Private Hire insurance covers and the optional extras you can add to your policy At Ascend Broking, we believe that insurance should be simple. Nobody should have to read through pages and pages of insurance jargon to understand the cover they have in place. In this post, we’ll look into what your Private…

Greater London introducing new traffic order

Transport for London, Direct Vision Standard and HGV Safety Permit From October 2020, all vehicles (other than exemptions) over 12 tonne will need a safety permit to operate in London. TFL are introducing a Traffic Order that requires the operators of vehicles with gross weight over 12 tonnes to have a HGV Safety Permit to…

Cybersecurity Best Practices for an e-Commerce Website

Cybersecurity Best Practices for an e-Commerce Website Recent decades have seen tremendous growth in online activities, including online shopping, thanks to the evolution of technology and e-commerce platforms. This growth was only accelerated by COVID-19 – the pandemic led many businesses, in an effort to stay connected with customers, to shift from traditional in-person communication…

Are you covering your volunteers correctly?

Are you covering your volunteers correctly? Volunteers are the life and blood of many charitable organisations, but are you looking after them as you should be - and could you be leaving your charity exposed by not doing so? Under the Employer’s Liability (Compulsory Insurance) Act 1969, all employers are required by law to insure…

Top 6 tradesman insurance claim types

Top 6 tradesman insurance claim types Damage to property Property damage from work carried out by a employees and subcontractors come in many different forms, such as a gardener felling a tree that falls on to a property and damages it, a plumber fitting pipework that springs a leak, or an electrician installing wiring that…

Per-mile Insurance

A different way to pay for your car insurance: pay-per-mile Pay-Per-Mile car insurance No one likes paying for their car insurance. We’re forced to buy it. It’s a pain. However, some new types of insurance are making it a slightly less bitter pill to swallow. We all know there are a few black box options…

Worldwide Service at your request

Worldwide Service at your request With a network of over 20,000 aircraft worldwide, we can take you anywhere around the world, which is why we take pride in operating 24 hours a day. We collaborate with our suppliers to ensure that every step of your journey has been catered for. Need to make a big…

How usage-based Fleet insurance works, it’s benefits and how to get a quote with Zego

How usage-based Fleet insurance works, it's benefits and how to get a quote with Zego At Zego, our Fleet insurance is designed to offer you a premium that matches the actual usage of your vehicles, so you always get a fair premium that is in line with your risk. Unlike traditional Fleet Insurance, for which you…

Increased risks from current haulage shortages

Increased risks from current haulage shortages Storage and distribution of raw materials and goods throughout the UK is the lifeline of business from manufacturing, hospitality, through to retail. The combination of Brexit and Covid-19 is impacting the supply chain and distribution channels, restricting both the movement of goods and people. This will affect: - availability…

Fleet Insurance

5 Tips for Better Courier Van Insurance If you’re looking for courier van insurance, you may need some help choosing it. Courier insurance is a necessity for businesses in that realm and here are some top tips to get you the right coverage at the right time. Insure Your Van Even If It’s Not Being…

Who is Admiral Jet?

Who is Admiral Jet? In short, we are an aircraft service provider that offers on-demand charter services tailor-made for your needs. “It’s not the destination. It’s the journey.” – Ralph Waldo Emerson, Self-Reliance This mantra may be about life, but at Admiral Jet, we take things literally. Our uncompromising standards of unparalleled…

Could you benefit from pay-by-mile car insurance?

Could you benefit from pay-by-mile car insurance? Traditional car insurance is not designed to benefit low mileage drivers. Millions of motorists around the UK who drive less than 7,000 miles per year are paying significantly more than those who spend more time on the road. After extensive research, pay-by-mile car insurers found the most popular…

Achieving profitable growth through long-term partnerships

Achieving profitable growth through long-term partnerships Over the past three years, Regions MD, Lee Mooney and, Sales & Distribution Director, Alex Hardy, have overseen a relationship model which has provided a strong partnership for brokers and exceptional growth balanced on sustainable profit. This success has been based upon doing things differently, building long-term partnerships and…

Concierge services at your request

We arrange straightforward luxury flights, perfectly We understand that booking foreign air travel can be complicated right now. If you are trying to book the best travel arrangements this summer, whether for business or leisure, we can help. We make it simple for you - making all the necessary arrangements, as well as efficiently guiding…

Courier Van Insurance

Everything you need to know about courier insurance and becoming a self-employed courier driver DOES MY BUSINESS NEED COURIER INSURANCE? If your business involves transporting other people’s goods for hire and reward then it’s a necessity that you’re covered by courier insurance. Remember, if you’re transporting your own goods for delivery then you will not…

Assessing health & safety risks – Covid-19 guide

Assessing health & safety risks – Covid-19 guide When changing operations and ways of working, a key part of the decision-making process involves the assessment and management of risks. During this unprecedented time, it is crucial to carry out suitable and sufficient risk assessments. Organisations must do all they can to keep up with the rapidly…

Admiral Jet Catering Service

All your questions answered about the catering with Admiral Jets Here are some of the common questions surrounding food and drink provided on your flight with Admiral Jets: I have a specific dietary requirement so what food will be available? Your Personal Account Manager will ensure all dietary requirements are accommodated. They will ask you…

Commercial Vehicle Show

Commercial Vehicle Show The Commercial Vehicle Show has just taken place at the NEC in Birmingham (31st of August to 2nd September, 2021), hosting over 200 exhibitors and welcoming representatives from commercial fleet operators, local authorities, vehicle service and repair businesses, distribution and courier operators and many others, at the largest opportunity for the industry…

Ascend Executive Newsletter Summer 2021

Ascend Executive Newsletter Summer 2021 As we reach the end of another unusual summer in the UK, the things we hold dear to us are perhaps even more important and protecting wealth and assets remains a priority both for you and for us. We know that a life less ordinary demands insurance of an entirely different calibre…

Shareholder Protection

Shareholder Protection Keep your business functioning if the worst happens One of the most serious events a business can suffer is the loss of a shareholder. Most businesses depend on their shareholders for leadership and direction – and the equity they provide. On the death of any shareholder, the Articles of Association or Partnership Agreement should stipulate…

What effect is Covid having on the hard market?

What effect is COVID having on the hard market? It is well established that the insurance market is in a period of hardening. Experts within the industry have been analysing the forces at play and the phrase ‘perfect storm’ has been used to signify what is a uniquely challenging set of pressures affecting the market.…

Key Person Cover

Key Person Cover Protect your biggest asset - your staff. Are there people within your business who are key to driving its profits, performance, technology and new sales? Is this person you? Every successful business relies on a team of key employees to enable it to thrive. This means that the loss of one of…

Private Jet concierge service exclusively for Ascend Executive customers

Travel in style with us! Ascend Broking are proud to be introducing our Private Jet concierge service exclusively for Ascend Executive customers. Quality and attention to detail you deserve for every step of your journey. Private jet charter is a great way for our clients to travel, and you’ll have access to a private concierge service…

Insurers have paid £968m in interim and final BI claims payments so far

The FCA calculates that 26,238 policyholders out of 41,666 who have had BI claims linked to the test case action accepted have received at least an interim payment so far! https://www.insurancetimes.co.uk/news/insurers-have-paid-968m-in-interim-and-final-bi-claims-payments-so-far/1438504.article Although you may or may not have received a settlement for your Business Interruption COVID claim, are you now happy in the knowledge that…

Summer Newsletter 2021

Welcome to our summer newsletter 2021! The Insurance Market While the rollout of a Covid-19 vaccine and the slow return to normality in 2021 has buoyed society & the market, there will still be challenges as the economy recovers from the deepest recession in modern history. In the insurance sector, many expect this economic…

Welcome, David Lloyd, to the Ascend team!

Welcome, David Lloyd! We are delighted to announce the addition of David Lloyd to the senior team at Ascend as Account Executive David’s insurance career spans 30 years and he spent the first 5 years as a personal lines advisor. He now focuses on motor fleet and motor trade business predominantly with a particular passion and…

D&O insurance explained

D&O insurance explained 5 key insurance issues - Increased corporate governance means more D&O exposures - D&O insurance covers claims resulting from managerial decisions that have adverse consequences - D&O insurance is a complex cover requiring attention to what is and isn’t covered - Common risk scenarios include failure to comply with regulation or laws,…

Ascend are proud to announce our new charity of the year: Kids Inspire

Ascend are proud to announce our new charity of the year: Kids Inspire We are delighted to announce that Kids Inspire (registered charity number 1129513) will be our Charity of the Year for the remainder of 2021, and 2022. Ascend will be raising money in aid of Kids Inspire through various fundraising efforts, from taking…

Welcome, David Beswick, to the Ascend team!

Welcome, David! We are delighted to announce the addition of David Beswick to the senior team at Ascend as Commercial Director. David is a well-known figure in the insurance industry, starting his career with Norwich Union in the Norwich office working in claims, before moving to London as a personal lines broker, then City Wall…

Turners alerts customers over worsening driver shortage crisis

Turners alerts customers over worsening driver shortage crisis “We’re close to the brink and so is everyone else,” said Turners (Soham) MD, Paul Day. “Are we delivering everything with a perfect service? No. Is everyone else? I don’t think they are. It’s getting worse. In another month it’s going to be really tight.” The UK…

The changing regulatory landscape in the UK and emerging risks

The changing regulatory landscape in the UK and emerging risks Historically, D&O risks were weighted towards securities litigation in North America, with many other territories experiencing a benign claim environment. This has changed in recent years. According to Chubb’s own data, the average large loss cost for D&O policies in the UK has tripled and…

Welcome, Jo, to the Ascend team!

Welcome, Jo! Jo started her career in London, organising training events for a large firm of accountants during the 1980’s. She then moved abroad in 1996 and spent six and a half years working in the Cayman Islands for a firm of solicitors. It was whilst she was there that she attended the Cayman Islands…

Marine Cargo Insurance and its importance

Marine Cargo Insurance and its importance Maritime transport is one of the safest channels for the movement of goods, however, inevitably, there are certain risks that, during their transfer, can generate damage or even total loss of cargo. That is why it is recommended to contract or enforce transfer insurance for all goods. The purpose…

The Role of Smartphones, Gamification and Rewards in a Business Driver Safety Programme

The Role of Smartphones, Gamification and Rewards in a Business Driver Safety Programme If your employees drive for work, you know that keeping them safe on the road can be challenging. Increasing pressure to meet deadlines, driver distraction, and rising substance abuse use and stress levels are not helping. The pandemic's emptier roads have even…

Is M&A insurance right for my deal?

Many SME business owners who are looking to exit their businesses may be unaware of the potential liabilities arising from their sale, as well as the full extent of cover available to them when they strike a deal with a buyer. Warranty and indemnity (W&I) insurance has not been available to small and micro M&A…

Whiplash reforms – in place from now

Whiplash reforms – in place from now From the 31st May new whiplash reforms came into legislation. WHAT DOES THIS MEAN? Historically, the limit for the Small Claims Track (the route to bring low value claims to court) was £1,000. The reforms will increase this limit to £5,000. This will mean that if a person…

Ascend launch new forest initiative

Aim to plant 10,000 trees As part of our commitment to the environment we have launched our Ascend Forest initiative. We have been working closely with #Time4Trees. Time4Trees is a new company established by land restoration specialists Land Logical and M&M Environmental. Land Logical’s core business is restoring damaged land, such as landfills and other…

Landmark judgment sees major insurance implications for dental profession

Law firm urges dental practices to obtain the right level of insurance as new judgment holds owner ’vicariously liable’ for negligence as opposed to the dentists involved. https://www.insurancetimes.co.uk/news/landmark-judgment-sees-major-insurance-implications-for-dental-profession/1437408.article The repercussions of this case mean that Dental Practice Owners can be held vicariously liable for the negligence of dentist professionals in their practice, speak to a…

Cyber Threats to the transport industry

Cyber threats and how they are being seen by the transport industry In the UK, according to the Government’s most recent Cyber Security Breaches Survey (June 2020) the extent of cyber security threats has widened and become more frequent with almost half of businesses reporting cyber security breaches or attacks in the previous 12 months…

Care for other road users

Care for other road users Our roads are becoming more and more congested but not just for road vehicles. The desire to remain fit and healthy during lockdown has seen more people regularly out walking, running and cycling. Yet with so many more people now getting around on foot, bikes and now also on e-scooters,…

Vessel accidents have increased, are you prepared?

Vessel accidents have increased, are you prepared? It is estimated that 3,000 containers have been lost at sea over the past few months alone. Compared to the 1,382 containers on average lost per year between 2008-2019, as reported by The World Shipping Council, that’s a big jump. What’s the reason for it? Why are vessel…

Covid-19 related claims

Covid-19 related claims: A practical guide for employees Employers’ Liability overview The responsibility of the employer Employers are responsible for the health and safety of their employees while they’re at work. If a current or former employee was injured or became ill at work, they may believe their employer is responsible and make a claim.…

Employers Liability claims in relation to COVID-19

As restrictions ease over the coming months businesses should be aware of potential Employers Liability claims in relation to COVID-19. This useful guide for employers includes preventative measures businesses can take to help manage these types of claims. Working from home It was supposed to be temporary, then it became less temporary, now many businesses…

Assessing health & safety risks through the pandemic and beyond

Assessing health and safety risks through the pandemic and beyond When changing operations and ways of working, a key part of the decision-making process involves the assessment and management of risks. During this unprecedented time, it is crucial to carry out suitable and sufficient risk assessment. Organisations must do all they can to keep up…

Assessing health & safety risks through the pandemic and beyond FAQ

Assessing health & safety risks through the pandemic and beyond FAQ What COVID-19 hygiene plans need to be implemented? A risk-based approach should be applied to cleaning areas likely to be contaminated. The findings of the work activity and site risk assessment should influence cleaning and disinfecting plans (what, how, when, who, etc). Reference…

Managing Escape of Water Risk in Residential Premises

Managing Escape of Water Risk in Residential Premises What do property owners and managers need to do? Within the residential setting, there is no one thing that will prevent an EoW loss. A loss is usually a culmination of several adverse actions / factors. Therefore, in order to reduce the likelihood and severity of an…

Training to help HGV drivers avoid cargo theft launched by NAVCIS

Training to help HGV drivers avoid cargo theft launched by NAVCIS Cargo theft is on the increase. Latest figures from NAVCIS, which is the police department responsible for dealing with freight crime, reveal 321 offences involving theft of HGVs or theft from HGVs have been reported since 1 January this year, amounting to losses…

What is FORS?

What is FORS? The Fleet Operator Recognition Scheme (FORS) is a voluntary accreditation scheme designed to help fleet operators improve fleet standards within their organisation. FORS offers a range of tools that help drivers, fleet managers, and organisations measure and improve performance across all aspects of their fleet operations, and demonstrate best practice. What…

Organisations’ exposure and implications

Organisations’ exposure and implications Access to organisations’ confidential information A data breach happens when an attacker gains illegal access to an organisation’s network through malicious activity, employee negligence, or third-party attacks. Data from millions of individuals was stolen in the well-publicised Blackbaud hack, affecting a number of charities. Such information can easily be sold on…

Back on the road

Back on the road Journeys for bus and coach operators have been impacted severely by lockdown, but the industry is now looking forward to a resurgence in business when day trips and excursions can resume from 17 May. There are already signs that demand for domestic holidays is picking up. The news will come…

Industry slams new UK plan to increase fines for hauliers carrying migrants

Industry slams new UK plan to increase fines for hauliers carrying migrants The UK government plans to increase fines for hauliers found carrying illegal migrants into the country, but it has been warned the new penalties, which would apply “irrespective of driver compliance with security measures and schemes”, could exacerbate the worsening driver shortage crisis. The…

HGV Classes Explained: Licence Classes 1, 2 & More

HGV Classes Explained: Licence Classes 1, 2 & More You need different types of driving licences to drive different types of HGVs. HGV classes essentially outline the type of licence you need to drive any given HGV. In this post we’ll explain what the various HGV classes mean. We’ll also look at some of…

FORS updates van training to help improve driver safety

FORS updates van training to help improve driver safety FORS has launched an update to its popular Van Smart eLearning module, to help upskill the growing fleet of light commercial vehicle drivers on our roads. The FORS Professional Van Smart eLearning module has been given an upgrade, including new learning scenarios and an updated…

Driving forward in a post-Brexit and COVID-19 world

Driving forward in a post-Brexit and COVID-19 world The world saw a turbulent change when national lockdowns took place due to COVID-19. As businesses across the industries had to temporarily close, agility was key for them to survive but, alongside the pandemic, the UK has also gone through a transition of leaving the European…

Tips for preventing theft from your worksite

Employee training Employees are vital to any business and can play a key role in safety and protection of the company and equipment. Companies should always check the backgrounds of any potential employees, if possible. Once on board, security guidelines and polices should be explained in detail and all staff need to be trained in…

Coronavirus (COVID-19): safer practice for international hauliers

Coronavirus (COVID-19): safer practice for international hauliers The Department for Transport has published guidance for hauliers making international journeys. The guide, last updated on the 28th March 2021, covers everything a haulier needs to know when it comes to safety, including rules on COVID-19 testing for hauliers and other topics such as: – Driver…

Is my gym Covid secure?

Is my gym Covid secure? Keeping yourself active is an essential part to your wellbeing. It is proven fact that exercise increases endorphins, which in turn lifts moods and makes you feel better. Being stuck in your own home for the last year has had major effect on people’s wellbeing, decreasing motivation while increasing…

The need for speed awareness

The need for speed awareness Most people who are caught speeding will receive a Fixed Penalty Notice (FPN) of a £100 fine and three points on their driving licence. It may be possible to avoid points and opt for a speed awareness course if one is offered, depending on which police force is handling the offence. The number…

Fire – a commercial kitchen’s biggest risk

A brilliant article by a Senior Risk Manager at QBE explains how you can protect your commercial kitchen from the risk of fire: If you operate a commercial kitchen, fire is one of the biggest risks. Most kitchens will build-up deposits of fat, oil and grease in the ventilation system (most notably, inside the…

The Ascend Forest Project – planting 10,000 trees

The Ascend Forest Project – planting 10,000 trees Ascend are helping to restore some of the world’s most threatened forests by planting a tree for every policy and vehicle insured in 2021. Where environmental change is concerned, everybody in the world benefits from trees, as they assimilate carbon dioxide (CO2) that in any case adds to a…

Road safety during Ramadan

Road safety during Ramadan Ramadan is the 9th month in the Islamic calendar and is a period during which participants observe strict rules that include fasting from food or water between sunrise and sunset. This year, it will start on the evening of Monday 12 April, and end on Monday 12 May. Workplace considerations…

Drivers to be Covid tested before entering the UK

Lorry drivers will be tested for Covid-19 before entering the UK amid surge in cases across Europe Lorry drivers arriving in England from outside the UK will be required to take a Covid-19 test within 48 hours of arrival, the transport secretary has announced. Grant Shapps said that from April 6 hauliers, including drivers…

Will your insurance policy respond correctly between BFSC & LOSC?

Is your contractors policy set up correctly? The insurance definition of BFSC & LOSC is different to the HMRC definition. Make sure you have the correct procedures in place to ensure your insurance policies respond in your time of need. Whilst it is difficult to provide an accurate definition (as the law does not provide…

TruckEast plants a tree for every Scania it sells

TruckEast plants a tree for every Scania it sells Scania dealer TruckEast has committed to planting and maintaining one tree for each retail Scania truck sold. The idea to create a TruckEast Woodland originated from a series of sustainability workshops the dealership held in 2019, where employees from across the business joined together to…

Is my shop covered?

With the country opening again recently, business owners have been able to return to their livelihood. If you are returning to your shop, bakery or tearoom, this is the type of cover you will need to look at and review. Shop insurance Shop insurance is an overview term for policies such as bakery insurance,…

What has Brexit meant for your business?

What has Brexit meant for you? With nearly 1 in 4 UK hauliers having already lost business due to Brexit, a survey reveals that many UK hauliers remain unprepared for the end of the Brexit transition period, with just 3% stating they are totally prepared for the transition. The majority stated they needed more…

How are care homes affected by the changing of restrictions?

The government have allowed care home residents in England two regular visitors indoors starting from the 12th April An article taken from the BBC explained the updates to care homes starting from the 12th April, as the rest of the country also enjoyed the lifting of some restrictions. The full article can be…

Tips when buying a used vehicle – Our buyers guide

Buying a used vehicle? The following 12 tips will help when buying a used car. Vehicle Identification Number (VIN) Check that the 17-digit vehicle identification number (sometimes know as V.I.N or chassis number) match each other around the vehicle. Typical locations are: – Inside the driver’s door jam – Driver’s footwell – Boot…

Social media in the transportation and logistics industry

Social media in the transportation and logistics industry In the logistics and transportation industry, social media is used as a tool for business only. There aren’t many interactions with customers. Some companies are unaware of the parameter of social media comments about services or even the system. Social media tools might pose helpful information…

Charity shops off to a flying start with restrictions lifting

Charity shops off to a flying start following the lifting of restrictions Charity shops across the UK have seen an increase in donations, even the ones that have remained closed, with items being left outside the shops. Charities have requested that items are not dumped outside the front of the shops. Once items are dumped…

Testing & Vaccination Challenges

If you’re considering COVID-19 testing in your workplace, whether for employees, visitors or contractors, it’s important you are aware of the possible potential implications for your liability insurance covers. Similarly, if you’re considering or are approached by a relevant authority about your premises/site being used as a testing facility (whether asymptomatic or symptomatic) or…

Is my business secure? – Security overview

Is my business secure? With everything starting to open again, business owners who haven’t been able to trade for the last year are able to get back to their livelihood and resume a bit of normality. The worst thing that could happen is to come back to your place of work and find it…

UK changing the law of using phones whilst driving

The Government is seeking to tighten the law around using a mobile phone whilst behind the steering wheel. It has been an offence under UK law since 2003 to use a hand-held mobile phone while driving. Drivers caught can expect to receive a fixed penalty notice (FPN) of £200 and six penalty points on…

Measures to Reinstate Plant, Equipment and LPS

This Loss Prevention Standard contains guidance on how to reduce risks when you are planning to reinstate process plant and equipment that have been shut down or mothballed on a temporary basis, for example in response to a business downturn or forced closure due to external factors such as an epidemic/pandemic event This document is…

DFT Announces Funding for Electric Vehicle Charge Points