- Efficacy cover, known as failure to preform

- Protects your liability for injury to third parties, or damage to third party property

- Turnover split between activities

- MOT Loss of Licence

- Defective Workshop Service Indemnity

- Commercial vehicle weight classes

- Storage arrangements for customer vehicles

- Engineering Inspections

Ascend will assist you risk manage the remaining elements of your business to tailor the policy to you, these can include but not limited to:

- Buildings (Or Tenants Improvements)

- Stock (Vehicle, Parts & Accessories)

- Demonstration Cover (Accompanied / Un-Accompanied)

- Courtesy/Loan Vehicles

- Public Liability

- Engineering Inspection & Breakdown

- Business Interruption

At Ascend, we have our dedicated experts who are able to provide solutions from start-ups through to multi-site locations and can even arrange self-insurance programmes for the larger operator.

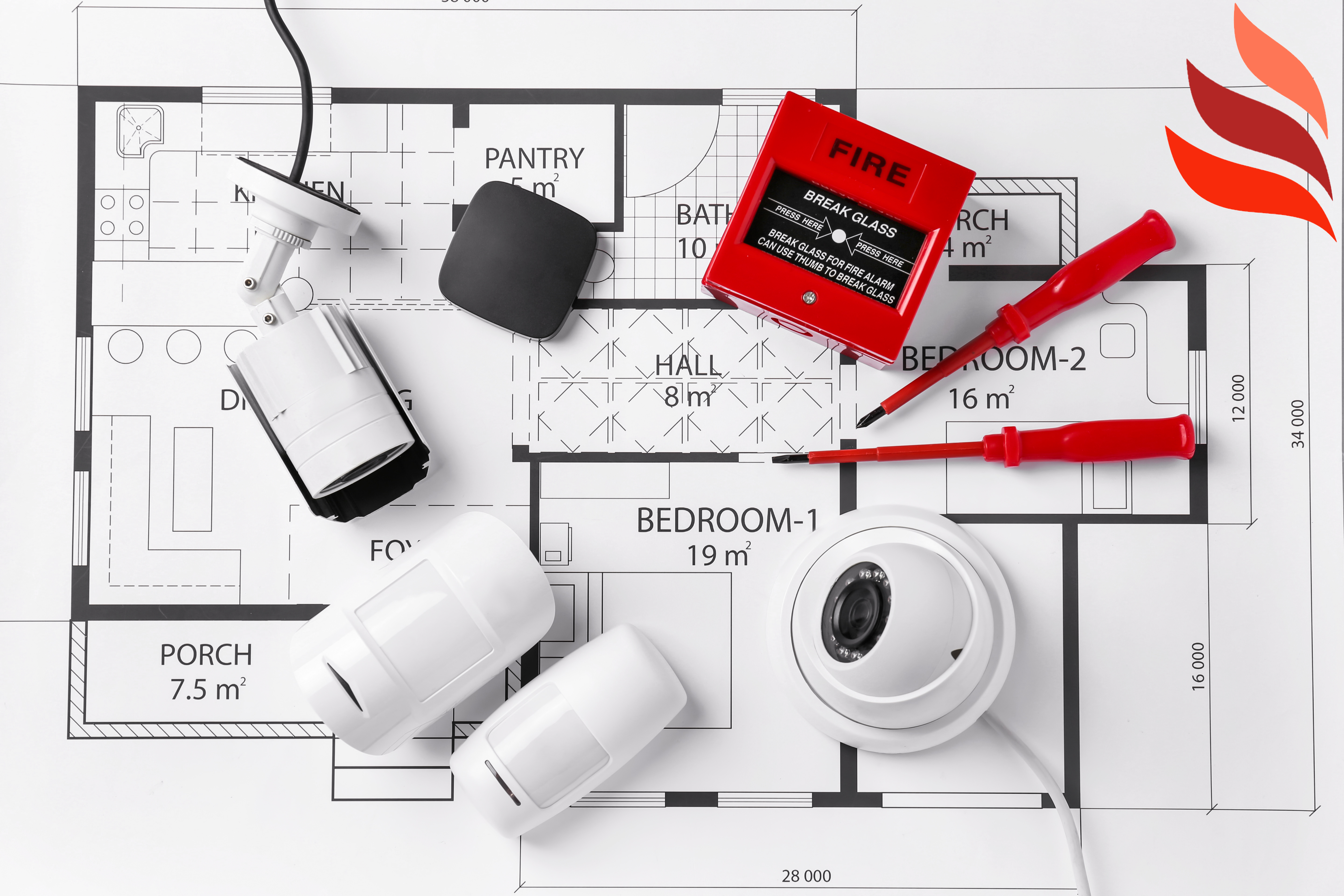

We appreciate the challenges that the fire & security industry faces, from national firms to sole traders. With this in mind, we have a bespoke fire & security Insurance which is tailored towards your trade activities, and we assist in building a policy to your specific cover requirements from a panel of our A rated insurers. We will highlight any differences in cover between insurers and ensure you are confident in your own insurance cover.

What services do we offer?

- Friendly and professional service

- Award-winning claims team

- Claims mobile app

- Experts in reducing cost

- 32 Years professional experience

- Transparent

- Independent

- Wide insurer panel

- No call centres

- Dedicated contacts

- No office closures

- No policy fees

Why you need Fire & Security Insurance

There are legal requirements in the United Kingdom to have certain insurance policies in place, for a Fire & Security sector, there are two fundamental elements of cover that you need to be aware of.

- Business Interruption

Business interruption insurance is insurance coverage that replaces business income lost in a disaster. The event could be, for example, a fire or a natural disaster. - Employers Liability

This is also a legal requirement to obtain if you have at least one employee, this does include many types of sub-contractor too. If you are caught without cover, you can be fined up to £2,500 per employee, per day.

Who to speak to?

Please contact Stuart Belbin who has extended knowledge in the Fire & Security and Commercial insurance sectors.

Stuart Belbin

Account Executive

M: 07736 956221 E: Stuart.Belbin@ascendbrokingold.co.uk