What is Aviation Insurance?

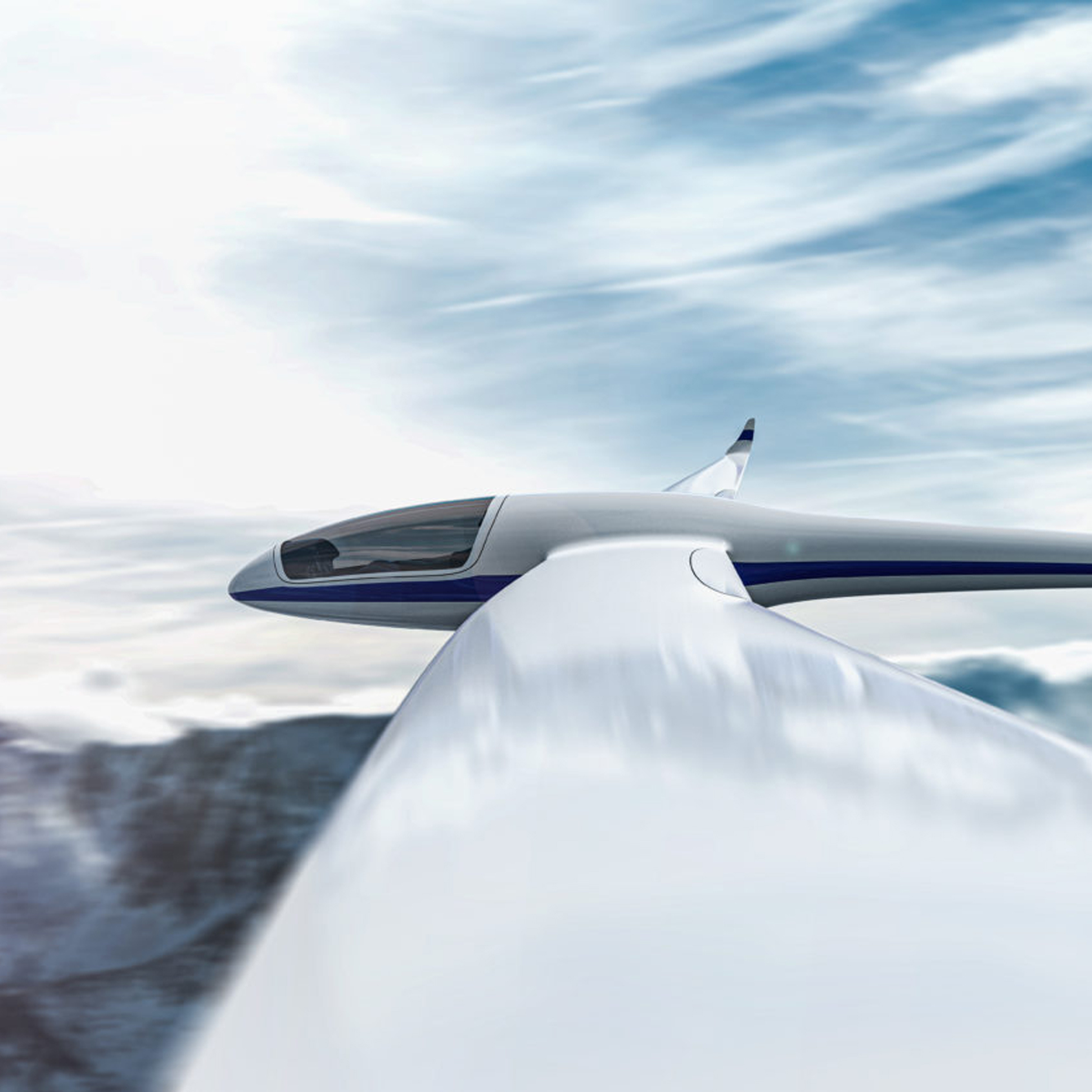

Business aviation serves a unique market sector of private owners, users and travellers for whom the travel experience is often beyond simply flying first class on a commercial passenger jet. Flying Private Aviation offers travellers complete control over the journey, right from departure time (and place), to in-flight service to arrival time (and place). Private jet owners, operators and travellers expect a world class, professional service.

Why Ascend for your Aviation Insurance?

Types of Insurance to consider:

Liability Insurance:

Liability insurance essentially provides cover against loss, damage or injury to third parties which include passengers, cargo, mail and baggage. Although different insurers may offer slightly different policy limits and definitions, they do not generally provide cover for the pilot in command (of an aircraft) or the actual aircraft.

NB: You must also carry evidence of this insurance onboard the aircraft at all times.

It is a legal requirement for any aircraft flying in the UK to have a minimum amount of liability insurance, as required by EU legislation. The minimum insurance requirements are set out in Regulation EC785/2004.

Hull Insurance:

A hull insurance policy indemnifies a loss or damage to your own aircraft. Hull insurance policies are generally arranged on an agreed value basis, where the value of the aircraft is agreed in advance. In the event of a total loss, insurers pay out the agreed value, rather than the current market value.

It is important to set a realistic agreed value sum insured. If you choose a value below the true value of the aircraft Insurers may, at the time of a loss, decide to declare the loss uneconomical to repair and then agreed a claim based on the agreed value. This may not fairly reflect the cost of replacement. However, if you overvalue your aircraft insurers may elect, when you suffer a significant loss, to repair the aircraft rather than ‘write it off’ even if you wish to have the aircraft declared a total loss

Additional Insurance:

In addition to the standard aviation risks an aircraft faces, Private Aviation owners and operators may also need to consider other types of insurances. Specifically:

Aviation Hull War Insurance:

This additional hull policy provides cover for loss of the aircraft due to war, hijack, confiscation, malicious damage and other similar risks.

Private jets frequently fly to hazardous destinations (where commercial airlines don’t) and the risk of confiscation by local aviation authorities, hijack, malicious damage and war risks along with the associated risks to the crew.

Crew Insurance:

It is common for pilots and crew flying corporate jets to be provided with an enhanced employee benefits package that includes loss of licence cover, personal accident cover and travel insurance.

Engine breakdown insurance:

This insurance covers damages caused to the engine by internal reasons (material failure, overheating). These are so-called “internal damages”. Events that affect the engine from the outside are covered by aircraft hull insurance. These are so-called “external damages”.

Get in contact with your maintenance company about how expensive this damage can be. We will be happy to send you the quotation if you provide us the aircraft type, the engine type, the year of construction and the registration number of the aircraft as well as the intended use.

A hull insurance indemnifies a loss or damage to your own aircraft.

Hull insurance policies are generally arranged on an agreed value basis, where the value of the aircraft is agreed in advance. In the event of a total loss, insurers will payout the agreed value, rather than the current market value.

It is important to set a realistic agreed value sum insured. If you choose a value below the true value of the aircraft Insurers may, at the time of a loss, decide to declare the loss uneconomical to repair and then agreed a claim based on the agreed value. This may not fairly reflect the cost of replacement. However, if you overvalue your aircraft insurers may elect, when you suffer a significant loss, to repair the aircraft rather than ‘write it off’ even if you wish to have the aircraft declared a total loss.

Liability insurance essentially provides cover against loss, damage or injury to third parties, which include passengers, cargo, mail and baggage. Although different insurers may offer slightly different policy limits and definitions, they do not generally provide cover for the pilot in command of an aircraft or the actual aircraft.

NB: You must also carry evidence of this insurance onboard the aircraft at all times.

It is a legal requirement for any aircraft flying in the UK to have a minimum amount of liability insurance, as required by EU legislation. The minimum insurance requirements are set out in Regulation EC785/2004.

We provide an exclusive legal service under our Management Liability Policy with access to a specialist litigation and commercial law firm that specialises not only in the management of legal crises, but also in the education and prevention of them in the first place.

- Support against all regulators including:- Information Commissioners Office (ICO),

– Health and Safety Executive (HSE),

– Charity Commission

– HMRC,

– Food Standard Agency (FSA),

– Trading Standards,

– Local Authorities,

– DEFRA. - Regulatory investigations

- Regulatory prosecutions

- Breaches of contract

- Fees for intervention

- Employment tribunal and ACAS claims

- Defence for the organisation itself

- £100,000 data protection breach

- Customer/supplier contact cover

- Employee theft cover

- Deprivation of assets

- Employment civil fines

- Pollution clean up cost cover

- Third party electronic funds transfer cover

- Loss of directors’ time

- Brand damage

- Employee engagement impact

- 24/7 out of hours crisis line

- Stress and worry for directors & managers

- Defence against employment tribunal claims

- £25,000 pursuit cover for contract disputes and debt recovery

- Legal defence for directors, trusteees, partners and officers

- Negative social media crisis and public relations costs

- Circumstance investigation/mitigation costs

- 24 hours, 7 days a week crisis line straight to a solicitor at no additional cost

- Legal advice line Mon-Fri 8am-6pm

- Legally privileged advice, support & representation

- Downloadable legal & regulatory advice, support guides, letters & templates

- Access to our digital tools via exclusive portal

Frequently Asked Questions

General aviationthus represents the ‘private transport’ and recreational components of aviation. It also includes activities surrounding aircraft homebuilding, flight training, flying clubs, and aerial application, as well as forms of charitable and humanitarian transportation.

How dangerous is flying? There are 16 fatal accidents per million hours of general aviation. It is fairly safe to assume that when a plane crashes and someone dies, everyone on board dies. By contrast, the death rate for automobile driving is roughly 1.7 deaths per 100 million vehicle-miles.

Nonmilitary flight operations are usually categorized ascommercial or general aviation. Commercial aviation concerns scheduled flights from larger tarmac airports that involve the transportation of passengers or cargo. General aviation, on the other hand, includes a wide range of aircraft.

A FederalAviation Administration spokesman says the agency has no authority to requireprivate aircraft be “The FAA’s authority is confined to regulations for safety,” said spokesman Lynn Lunsford.

Anypilot flying an aircraft they do not own should carry their own The aircraft owner’s insurance covers passengers and the aircraft itself, but not the pilot. Pilots should have the following: … Aircraft physical damage coverage.

Live Directors & Officers News From Across The Web

- The hacker’s toolkit: 4 gadgets that could spell security troubleon May 6, 2024 at 9:30 am

Their innocuous looks and endearing names mask their true power. These gadgets are designed to help identify and prevent security woes, but what if they fall into the wrong hands?

- Pay up, or else? – Week in security with Tony Anscombeon May 3, 2024 at 2:59 pm

Organizations that fall victim to a ransomware attack are often caught between a rock and a hard place, grappling with the dilemma of whether to pay up or not

- Adding insult to injury: crypto recovery scamson May 2, 2024 at 9:30 am

Once your crypto has been stolen, it is extremely difficult to get back – be wary of fake promises to retrieve your funds and learn how to avoid becoming a victim twice over

Who to Speak to?

Matthew’s contact details can be found below or, if you would prefer, please complete the contact form at the bottom of this page and Matthew will contact you at your convenience.

Matthew Collins

Managing Director

Matthew.collins@ascendbrokingold.co.uk | Office: 01245 449061 | Mobile: 07901 551965